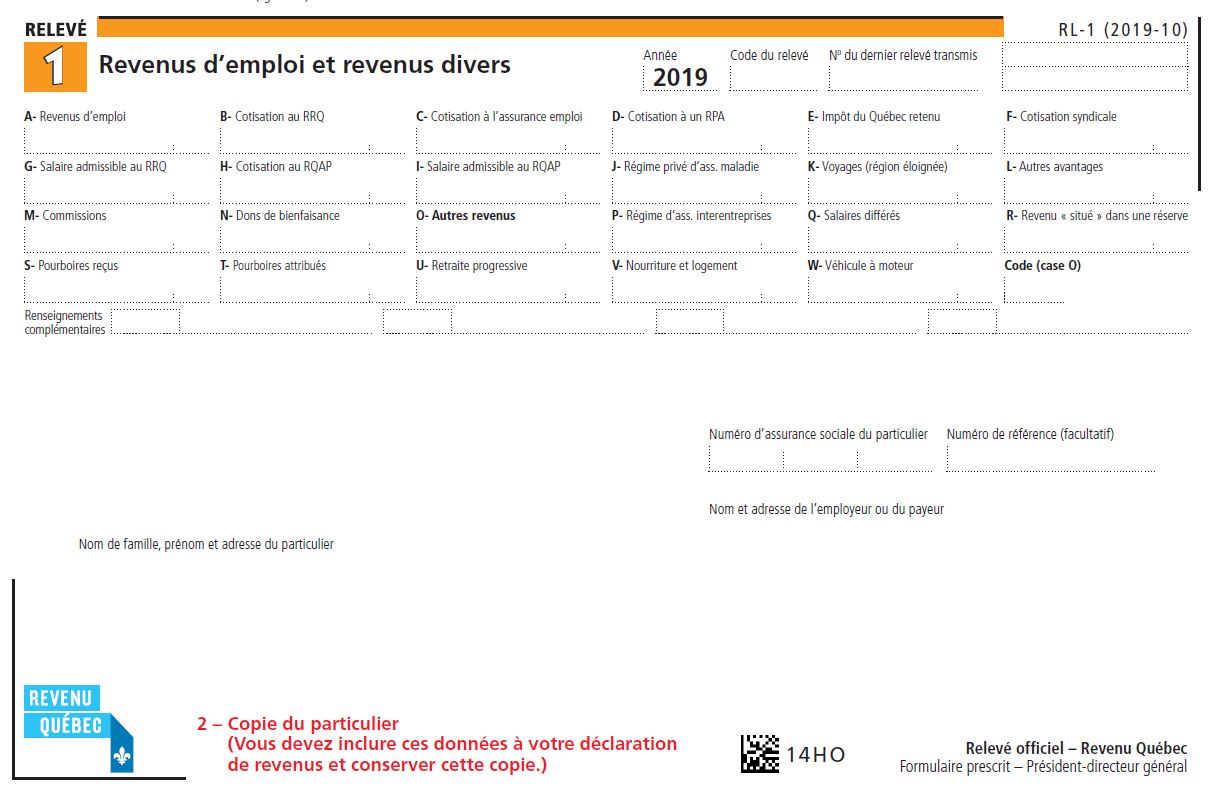

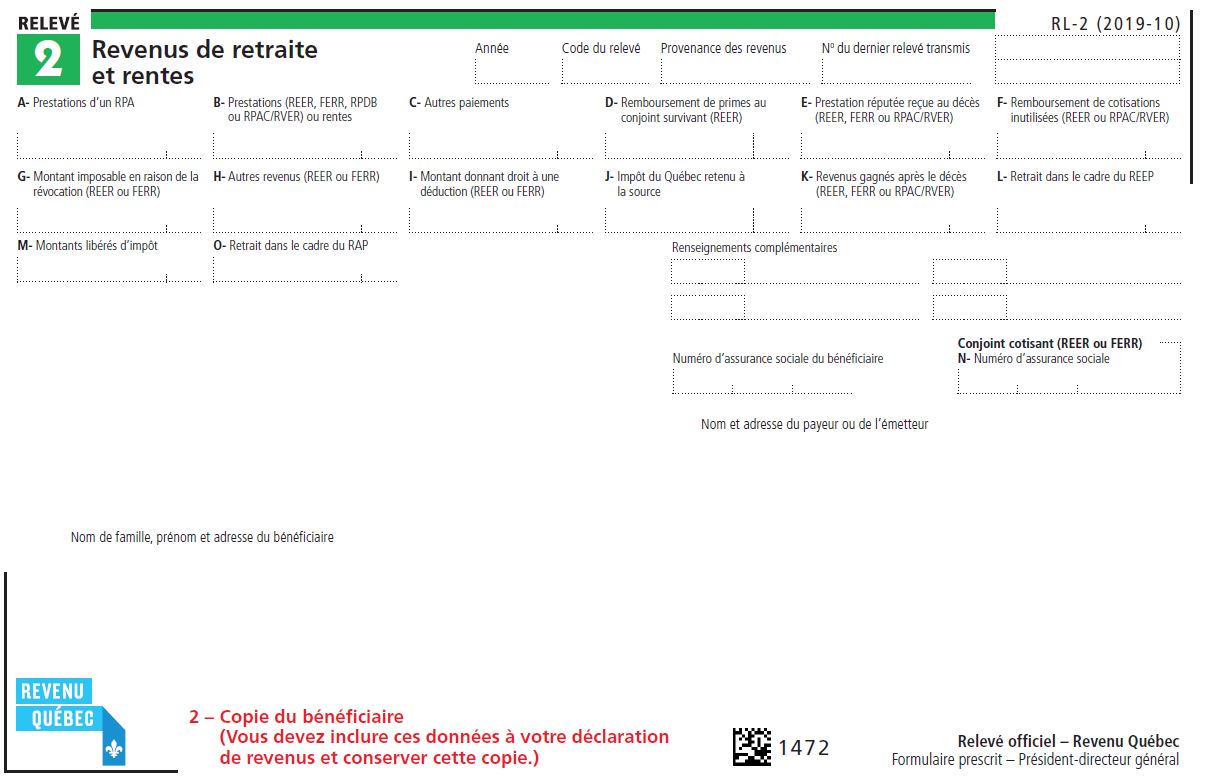

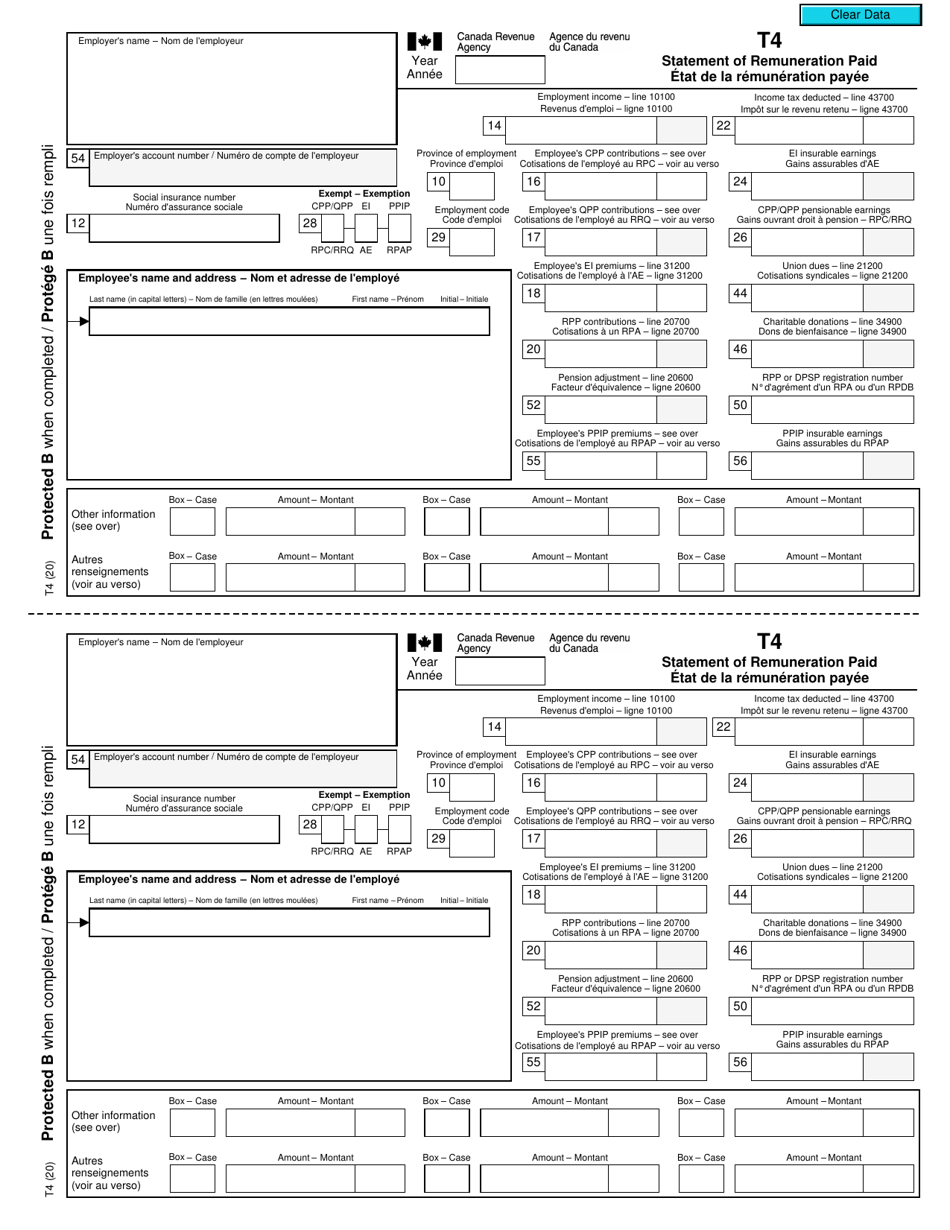

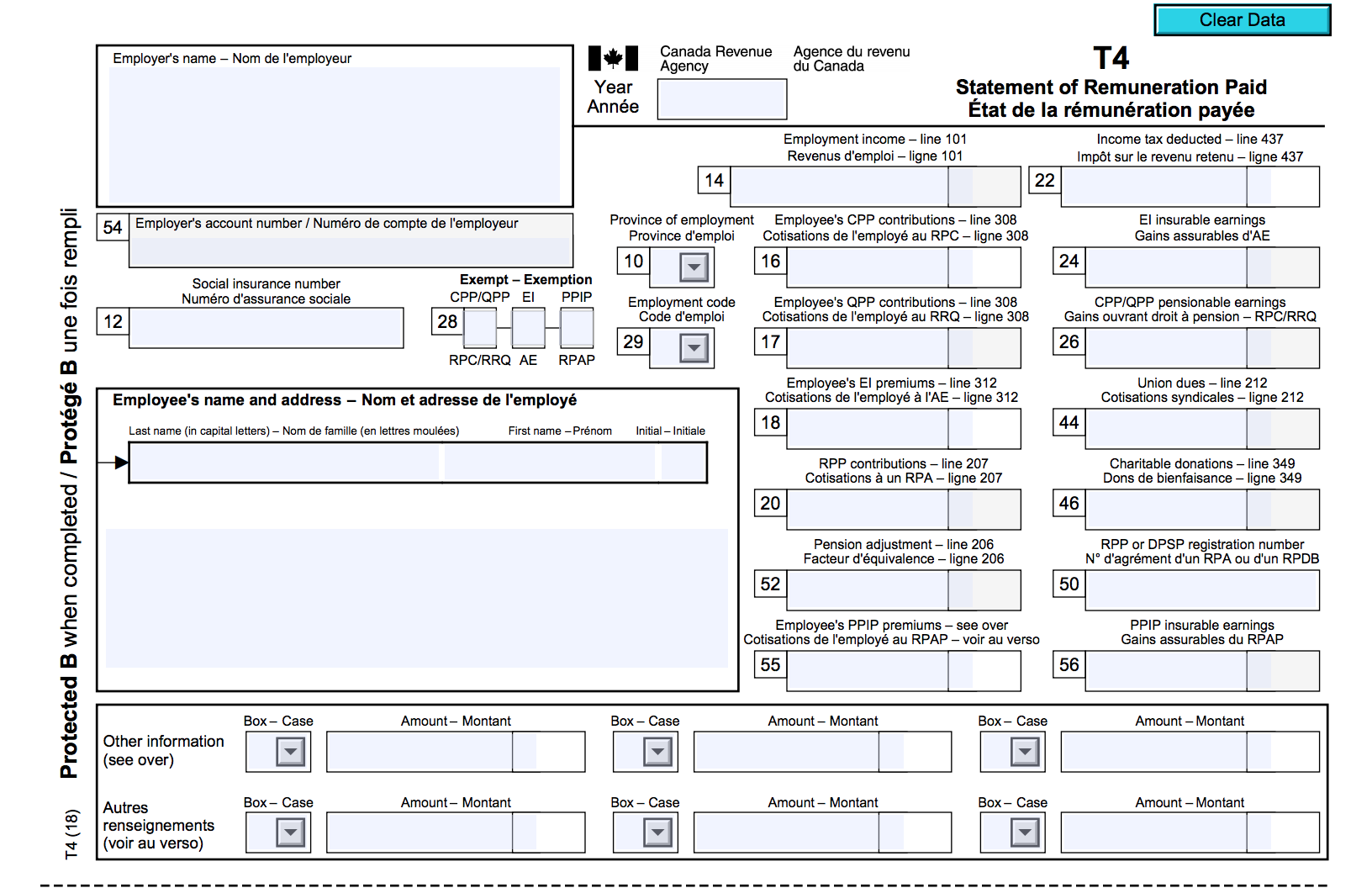

CCH iFirm Tax Forms 19 v50 (2802) T4 Boxes 30 to Other Information The "Other information" area at the bottom of the T4 slip has boxes for you to enter codes and amounts that relate to employment commissions, taxable allowances and benefits, deductible amounts, fishers' income, and other entries if they apply The boxes are not prenumbered as in the top · Where does a T4 slip come from?T4 (and RL1 in QC) yes No Annually, at the end of February of the following year Salary, tips, employment commissions and other remuneration (eg employer contributions) T4RSP (and RL2 in QC) No yes Annually Withdrawal or in the case of death DPSP (Deferred profit sharing plan) Receipt or slip Issued by employer;

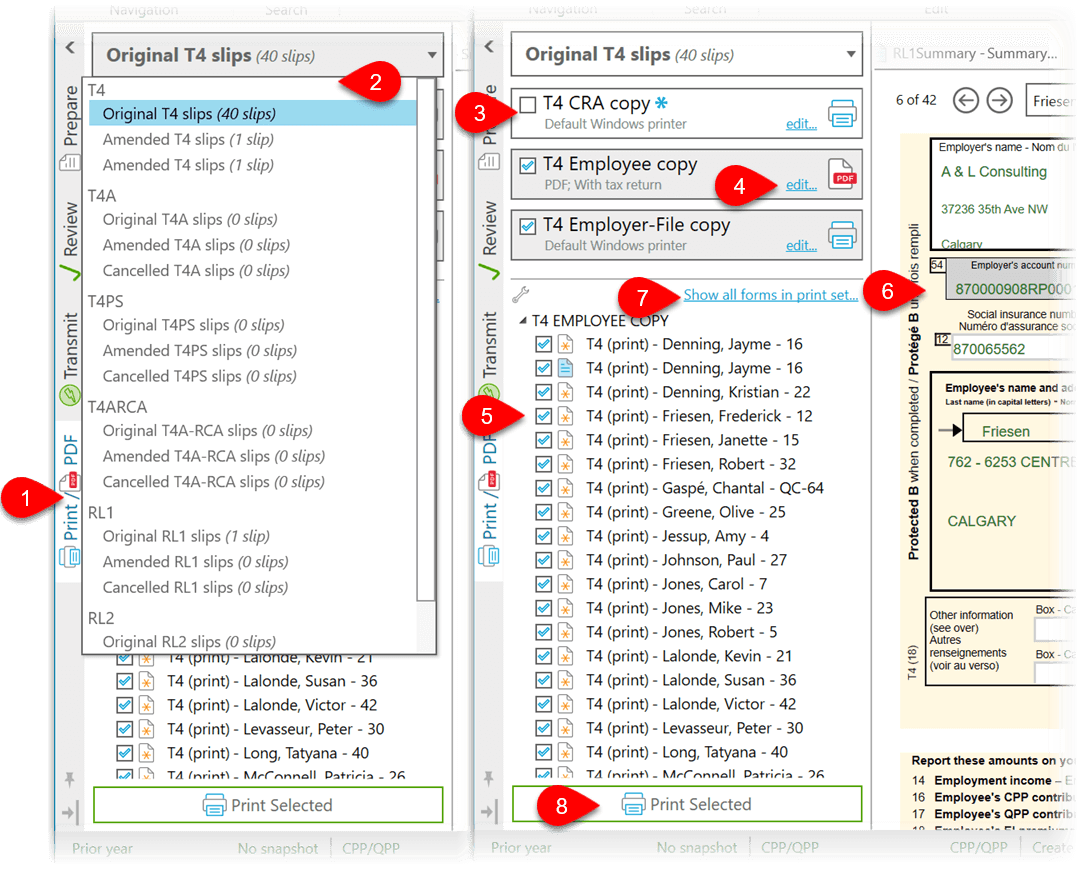

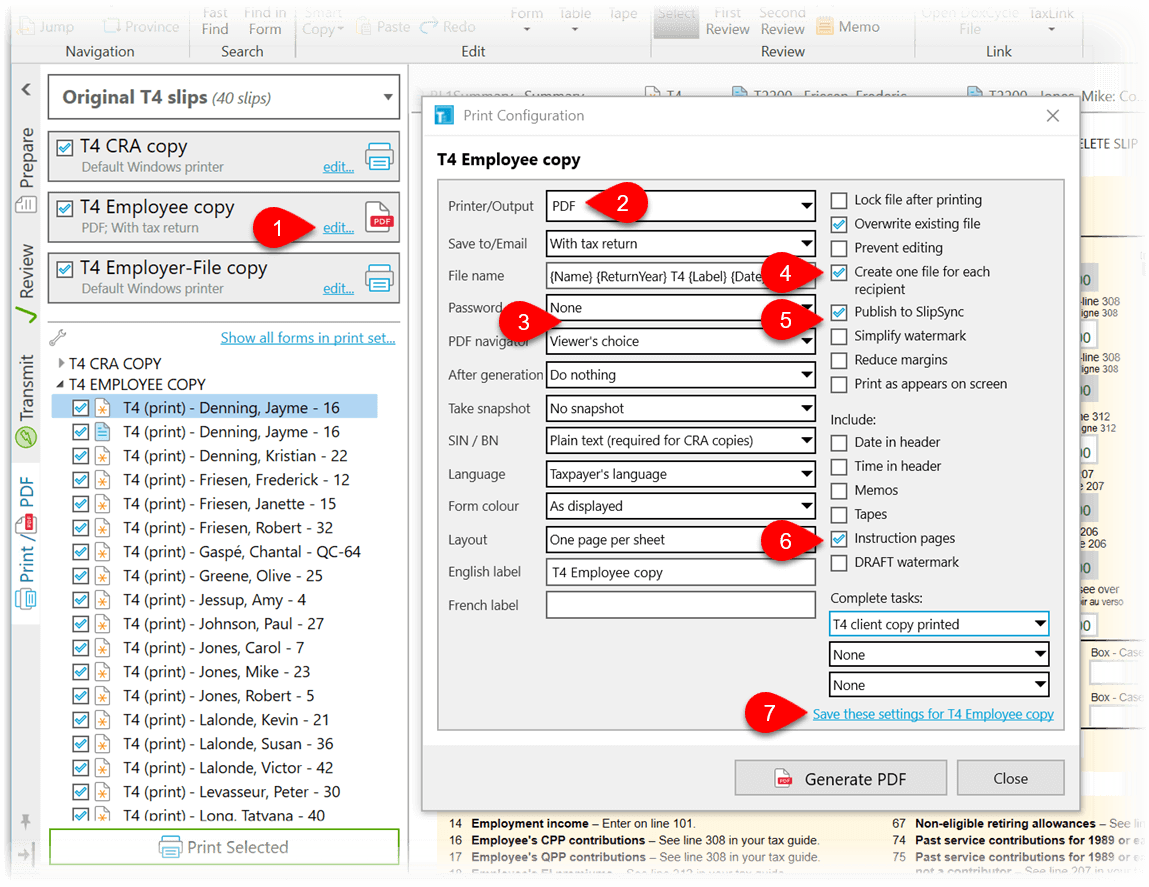

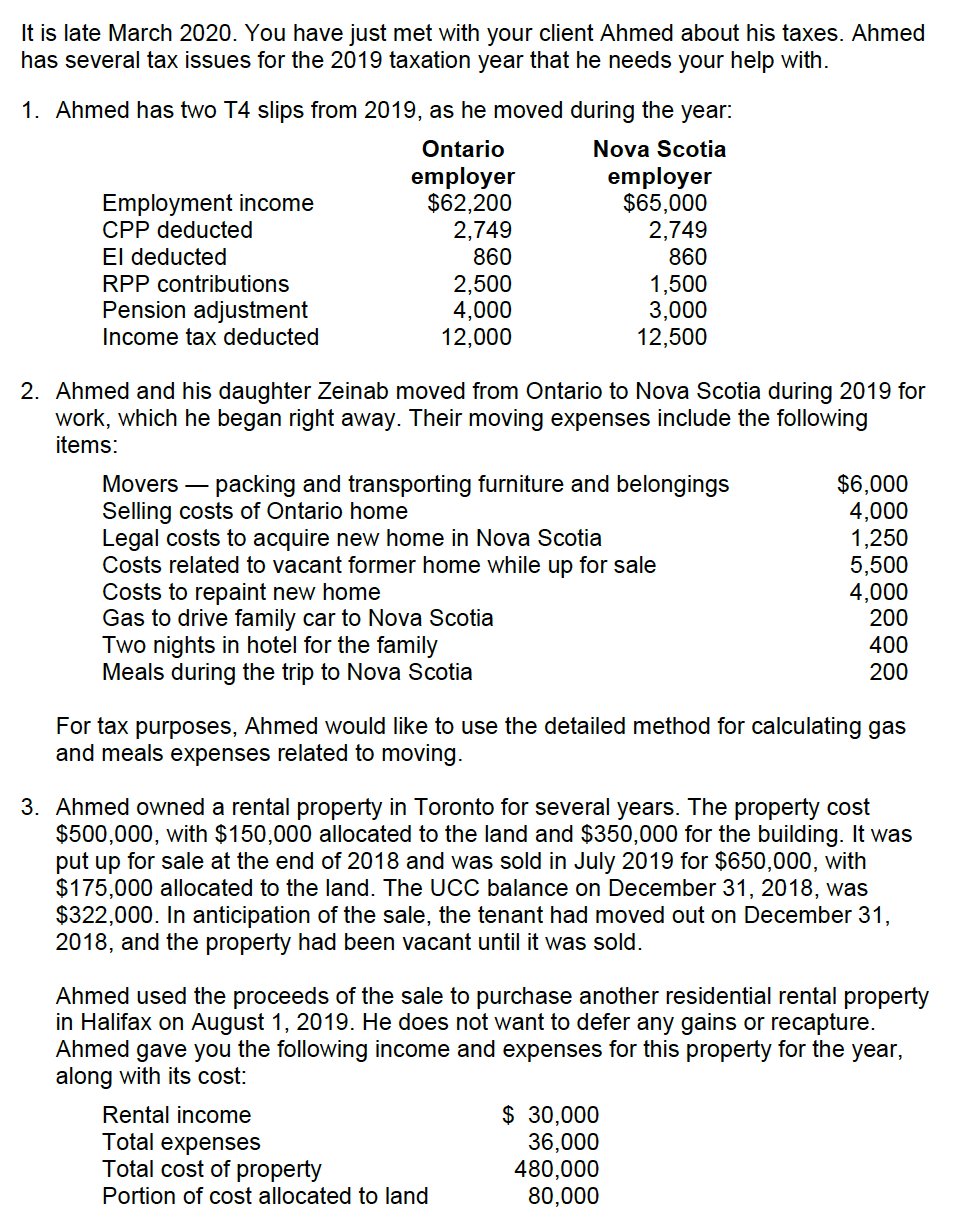

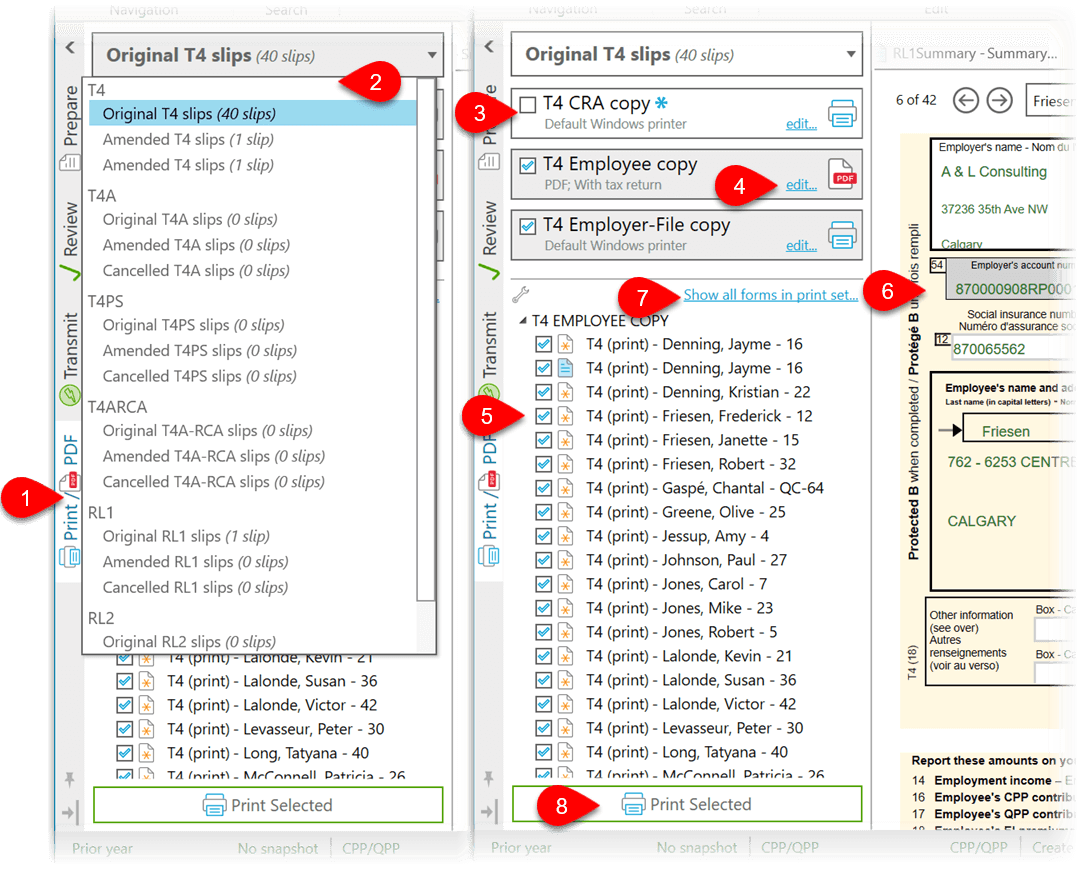

Print Pdf Slips Taxcycle

What are t4 tax slips

What are t4 tax slips-UBC issues tax slips online as PDFs that are identical to the printed form and are accepted by the Canada Revenue Agency (CRA) when filing your taxes Faculty, staff, and student employees can now download their 19 T4 and/or T4A statements for their tax returns via the Faculty and Staff SelfService portal How to download your statement Log into the Faculty and Staff SelfServiceT4 and RL1 Slips Box Options Refer to the tables below for information about which taxable earnings, benefits, and deductions are supported for filing T4 and RL1 slips with Sage 50 AccountingConsult your accountant or the Canada Revenue Agency for more information on reporting benefits and other income and deduction amounts

Sample Forms

· T4 and T4A slips for the 19 tax year will be available online via Employee SelfService (ESS) for all active University of Toronto employees on Tuesday, February 25, Paper Tax Slips for Active Employees Active employees who have requested to receive T4 paper delivery on ESS prior to January 31, will receive 19 tax slips in the mailT4 Slip adjustment update T4 Slips form can now be adjusted directly without changing the underlying payroll data New employees can also be added only for T4 reporting 23 Dec 19 CRA Tax Tables updated to Jan The Jan CRA Tax Tables updates are now available in SimplePay and will apply to pay periods from Jan 19 Dec 19 Alberta revises Statutory Holiday · Definition A T4, or a Statement of Remuneration Paid, is an information slip prepared and issued by an employer to tell you and the Canada Revenue Agency (CRA) how much employment income you were paid during a tax year and the amount of income tax that was deducted Use T4s in preparing and filing your Canadian income taxes

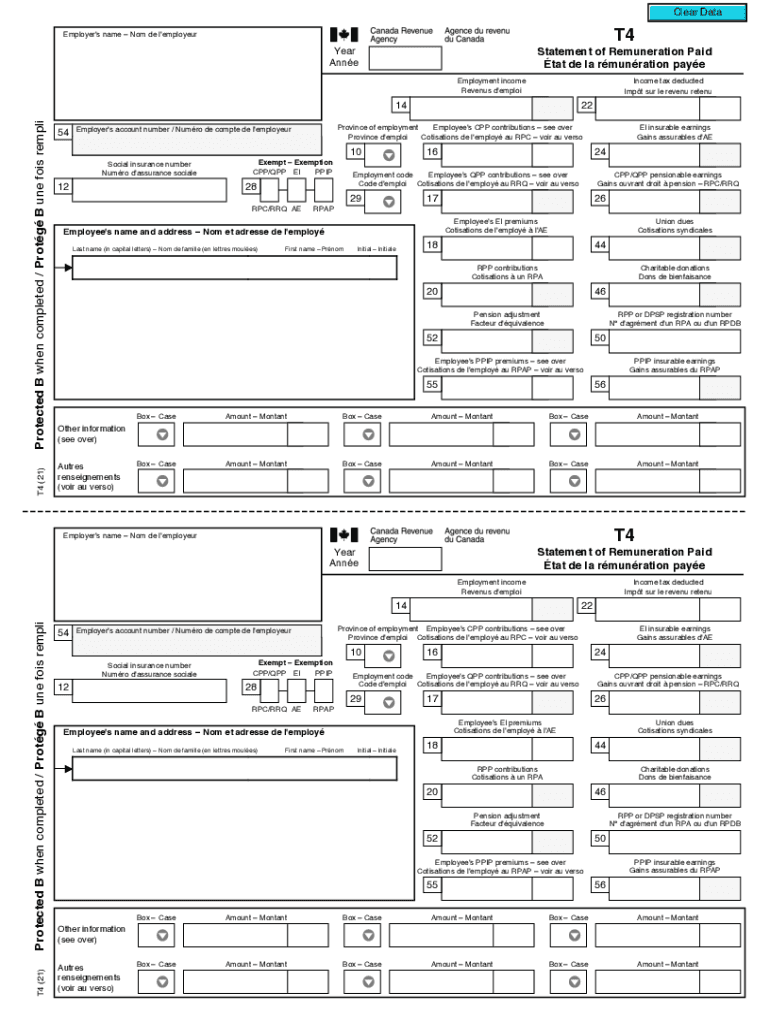

Business> Personal Tax> T4 Slips T4 Slips Requirements and Timing Employment income is included on a T4 for the year in which it is received, not earned, as per s 5(1) of the Income Tax Act, which states "a taxpayer's income for a taxation year from an office or employment is the salary, wages and other remuneration, including gratuities, received by the taxpayer in the year"On the T4 slip, these benefits are reported in Box 40 (Other Information) Additional Tax Reporting Due to COVID Subsidiary Programs For the tax reporting year, CRA has introduced four new codes to the 'Other Information' section of the T4 slip In addition to reporting employment income in T4 slip Box 14 all employers that paid employment income to employees on a pay date that fellCCH iFirm Tax Forms 19 v50 (2802) T4 Box 26 CPP/QPP Pensionable Earnings Starting in January 12 (for the 11 tax year), box 26 must always be completed In most cases, boxes 14 and 26 should be the same amount You have to complete the box in all situations, up to the maximum pensionable earnings for the year If there are no pensionable earnings, enter "0"

When you drive with Uber, you're an independent contractor Similar to a small business owner, your income from your ridesharing business is not reported on a T4 slip You can find your annual Tax Summary on driversubercom or through the link below While this is not an official tax document, it will help provide you the information you need to complete your taxesBox 40 is a section on your T4 – Statement of Remuneration tax slip where your employer lists out your other taxable allowances and benefits besides your wages or salary Not everyone will have a Box 40 amount on their T4 slip However, if you do have an amount for Box 40, that same amount is also included in Box 14 Total Employment IncomeCCH iFirm Tax Forms 19 v50 (2802) T4 Box Registered Pension Plan Contributions Enter the total amount the employee contributed to a registered pension plan (RPP) If the employee did not contribute to a plan, leave this box blank Enter any deductible retirement compensation arrangement (RCA) contributions you withheld from the employee's income Do

I Got This Message From The Cra Did I File My Taxes Incorrectly Personalfinancecanada

T4 Slip Form Page 1 Line 17qq Com

T4RSP Slip 19 issue with software unanswered by ProFile Hi, thank you for using Intuit ProFile Community Like previously mentioned there is no issue with ProFile reporting RRSP income for information correctly entered on the T4RSP slip screen Also, a carry forward of any type will not affect slip entries for the current year If you need assistance, call us at HopeFiling T4 and T4A Slips for 19 ComVida CVC51 provides two main filing methods – paper or electronic submission The electronic method will create an XML file which can be sent to the CRA through the internet The CRA requires mandatory electronic filing in XML format when employers file more than 50 (per slip type) T4, T4A, etc · COVID 19 New reporting requirements on T4 tax slips For the tax year, the Canada Revenue Agency (CRA) has introduced new boxes in the "Other information" area at the bottom of the T4 slip to help them validate payments made under emergency COVID19 – Benefits and services, where applicable These new boxes are 57 – Employment Income – March 15 to

Print Pdf Slips Taxcycle

Your 18 Tax Checklist Investors Group

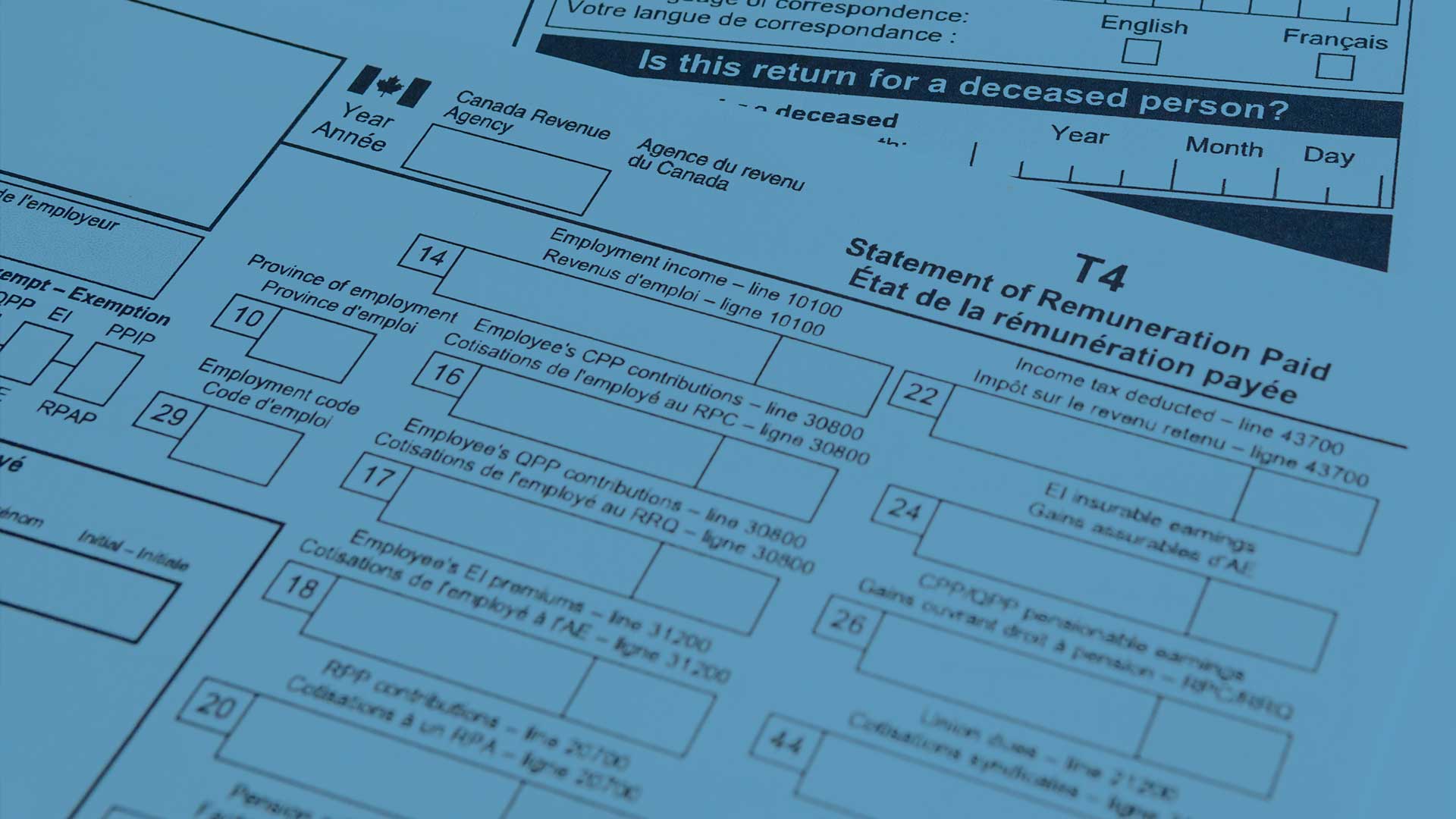

Human Resources 19 T4 remuneration slips are now available to McMaster employees through Mosaic selfservice Employee T4 slips are available electronically only You can view and download T4 slips by logging into Mosaic, visiting the employee selfservice section, and selecting the T4 tile Browser popups must be allowedCCH iFirm Tax Forms 19 v50 (2802) T4 Statement of Remuneration Paid Issuing a T4 Slip You have to complete T4 slips for all individuals who received remuneration from you during the year if you had to deduct CPP/QPP contributions, EI premiums, PPIP premiums, or income tax from the remuneration;A T4 slip should

T4 Vs T4a What S The Difference Loans Canada

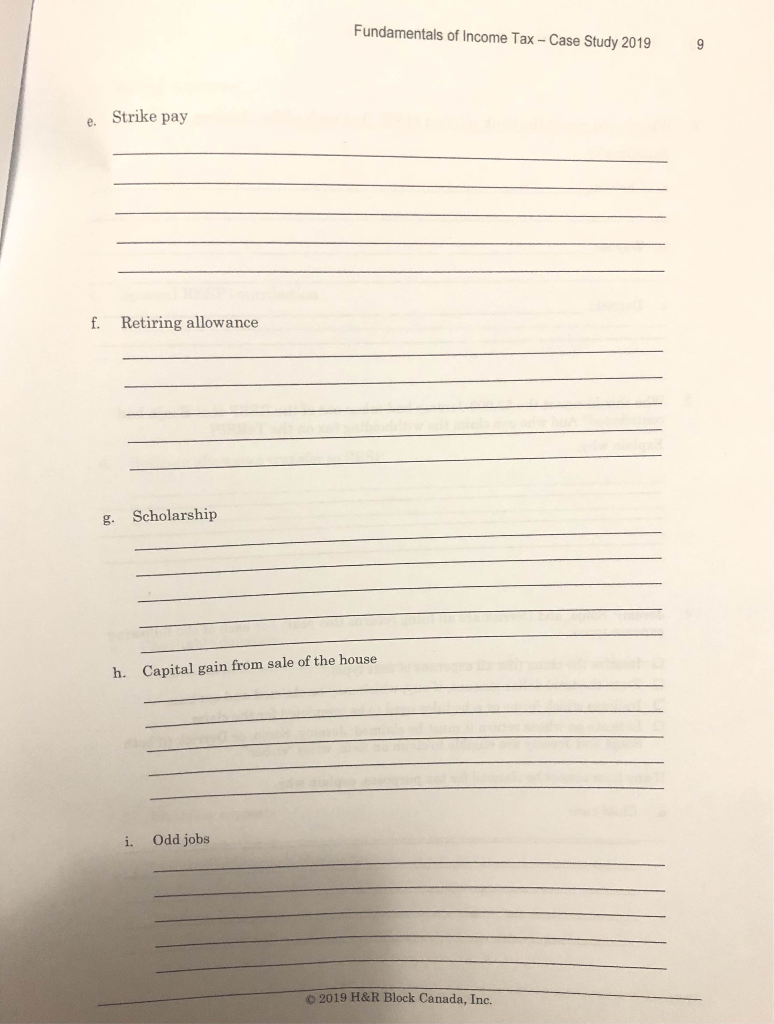

8 Fundamentals Of Income Tax Case Study 19 1 Chegg Com

· Overview If you need a T4 slip for the current tax year, only your employer can provide it to you For previous tax years, however, you can request a copy from the Canada Revenue Agency by calling If you are waiting for this year's T4 slip, note that your employer has until the end · Solved If I enter only 18, it tells me to go back and enter 19 Line 18 Employee's EI premiums Total of box 18 from all T4 slips Line 19 Employer's EI premiumsT4s must be filed with the CRA no later than February 28 (or February 29 if it's a leap year) However, if you are filing with an online payroll platform, the date may be earlier For example, if you are using Knit, the last day to request Knit to file T4s on your behalf is Monday, Feb 25, 19

Profile Fx Info And T4 Youtube

Difference Between T1 And T4 Income Tax Tax Walls

February 22, 19 SHARE Employees can now download tax slips from the Mosaic system for 18 New this year, T4 slips will only be available online and not distributed by mail "Online tax slips allow for secure, instant delivery for employees," says Franca BertiBogojevic, Director of McMaster Human Resources Services and Systems "This also helps with record retentionThe remuneration was more than $500;T4 tax slips for 18 and subsequent years will be provided to McMaster University employees by electronic delivery through Mosaic Electronic delivery is fast, secure, and allows employees to print tax slips at their convenience or to download a digital copy of their slip Recent amendments to the Income Tax Act now allow employers to use electronic distribution of T4 tax slips and the

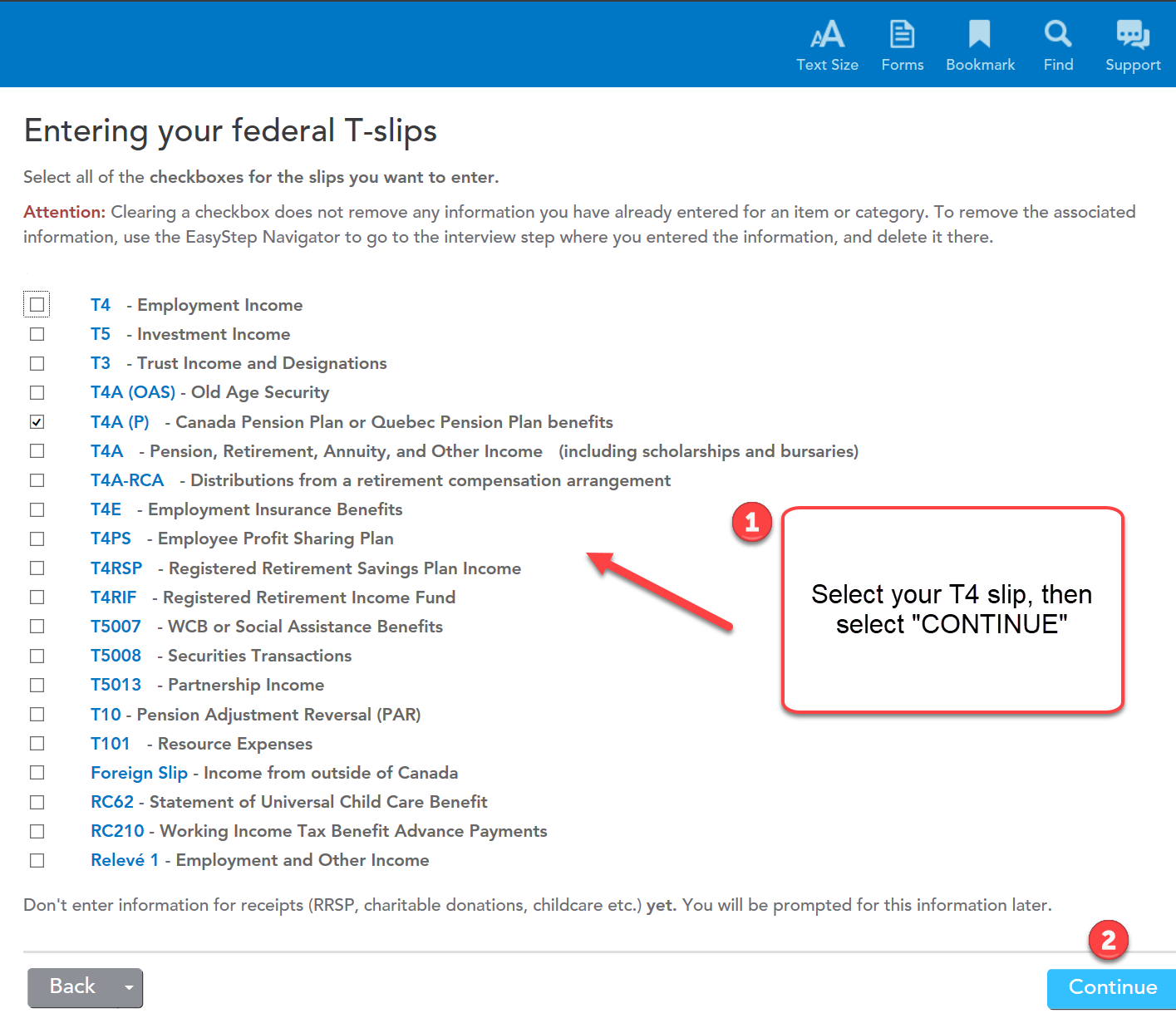

How Do I Enter A T4 Slip And Matching Rl Slips

Domestic Employer T4 Slip T4 Summary Nannytax Canada

· During 19, two or more employee IDs were created for you and you received earnings under multiple employee IDs In this case you will receive a T4 slip with the earnings from each employee ID Regardless of the reason, if you receive more than one T4 slip from the College, you must report all T4 slips when preparing your 19 tax returnEach of your employers will issue a T4 slip for your employment for the year When an employer gives you a T4 slip, they also send a copy of it to the CRA Employers have until the end of February each year to issue their employees' T4 slips for the preceding tax yearIssued by Desjardins When Details PA;

Sample Forms

What Is Line Of Your Tax Return

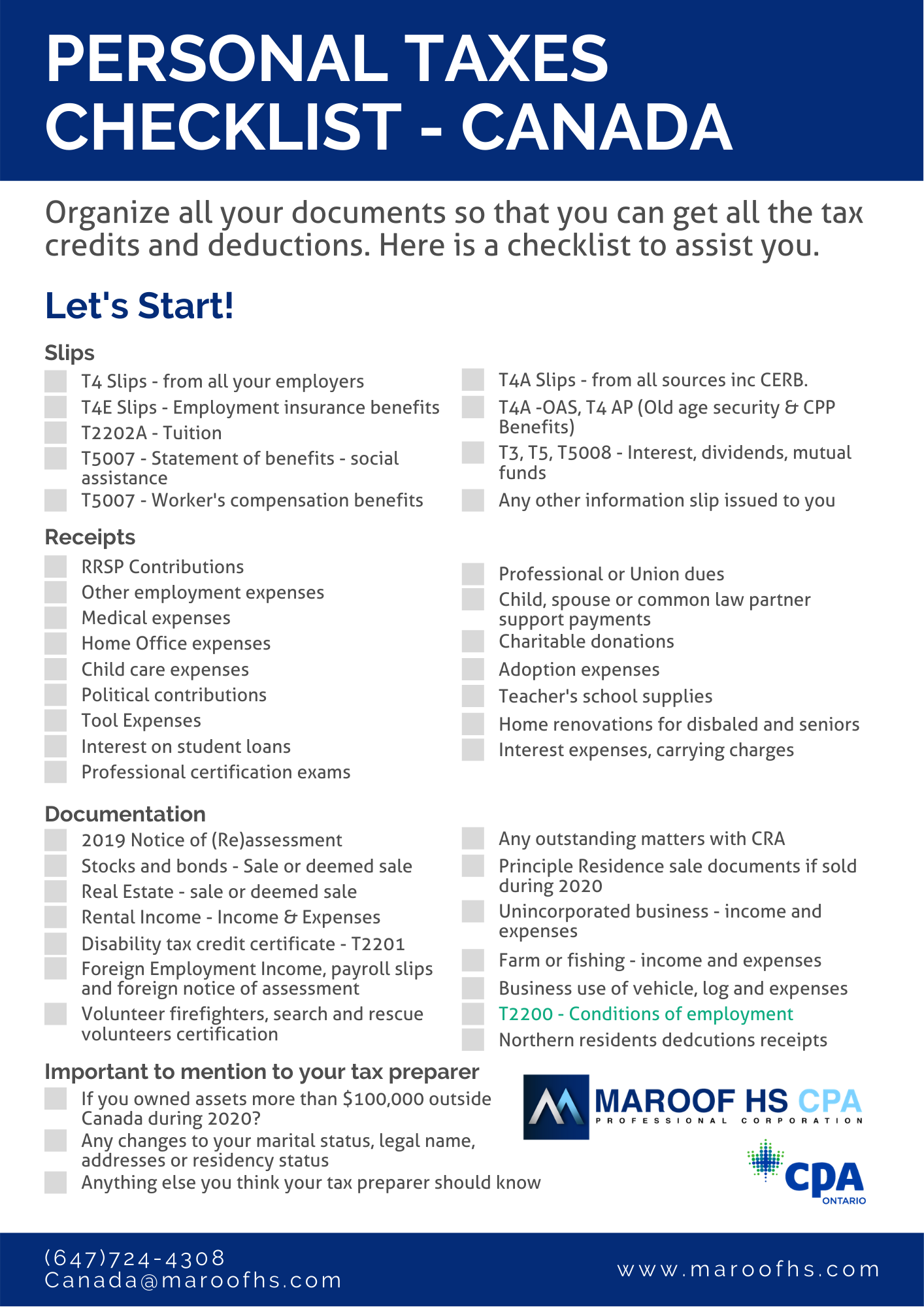

Filing T4 and T4A Slips for 19 ComVida EMS 42 provides two main filing methods – paper or electronic submission The electronic method will create an XML file which can be sent to the CRA through the internet The CRA requires mandatory electronic filing in XML format when employers file more than 50 (per slip type) T4, T4A, etc · June 6, 19 Tax reporting of employment or investment income using Tslips is generally straightforward Usually, an employer issues a T4 slip to each employee, which details his or her employment income for the yearYour 19 Tax Checklist Get ready for tax season with our 19 (T4) and employee profit sharing E (T4PS) slips * Employment Insurance slip (T4E) * Pension, retirement and annuities income slips (T4A) * Registered plan income (T4RSP & T4RIF) slips * Old Age Security (T4AOAS) and CPP (T4A(P)) slips * overnment income slips for social assistance or workers' G

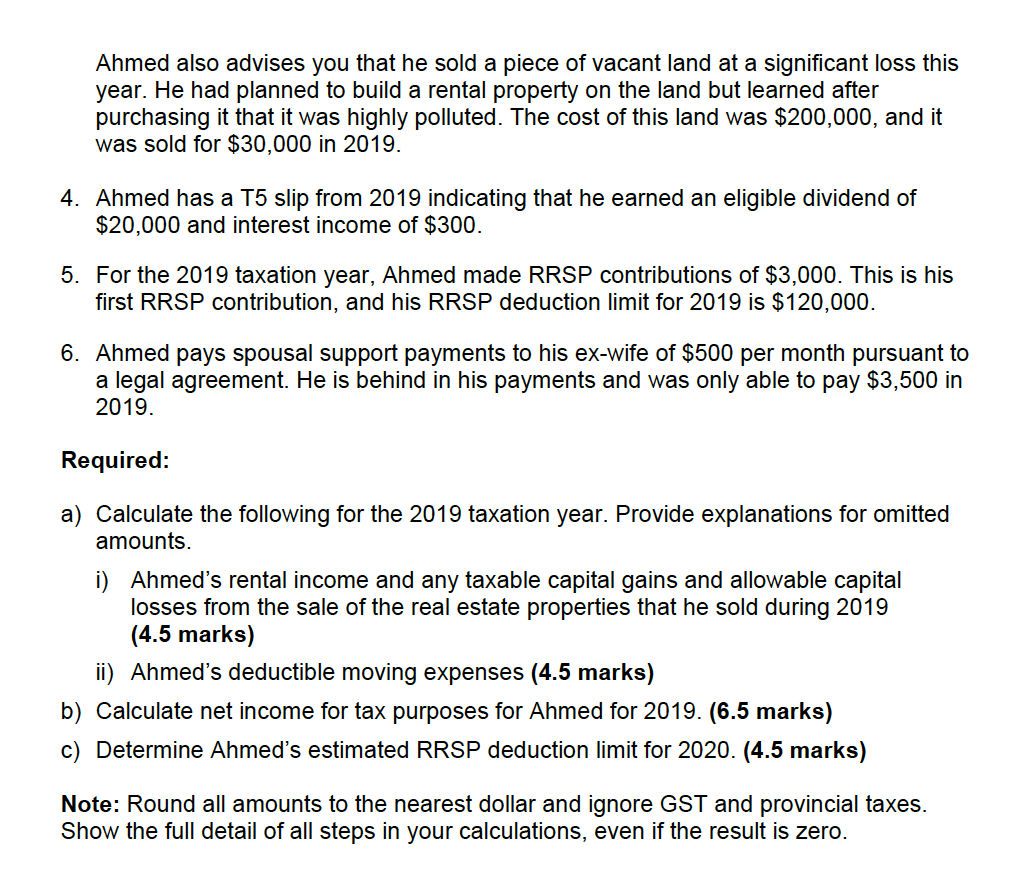

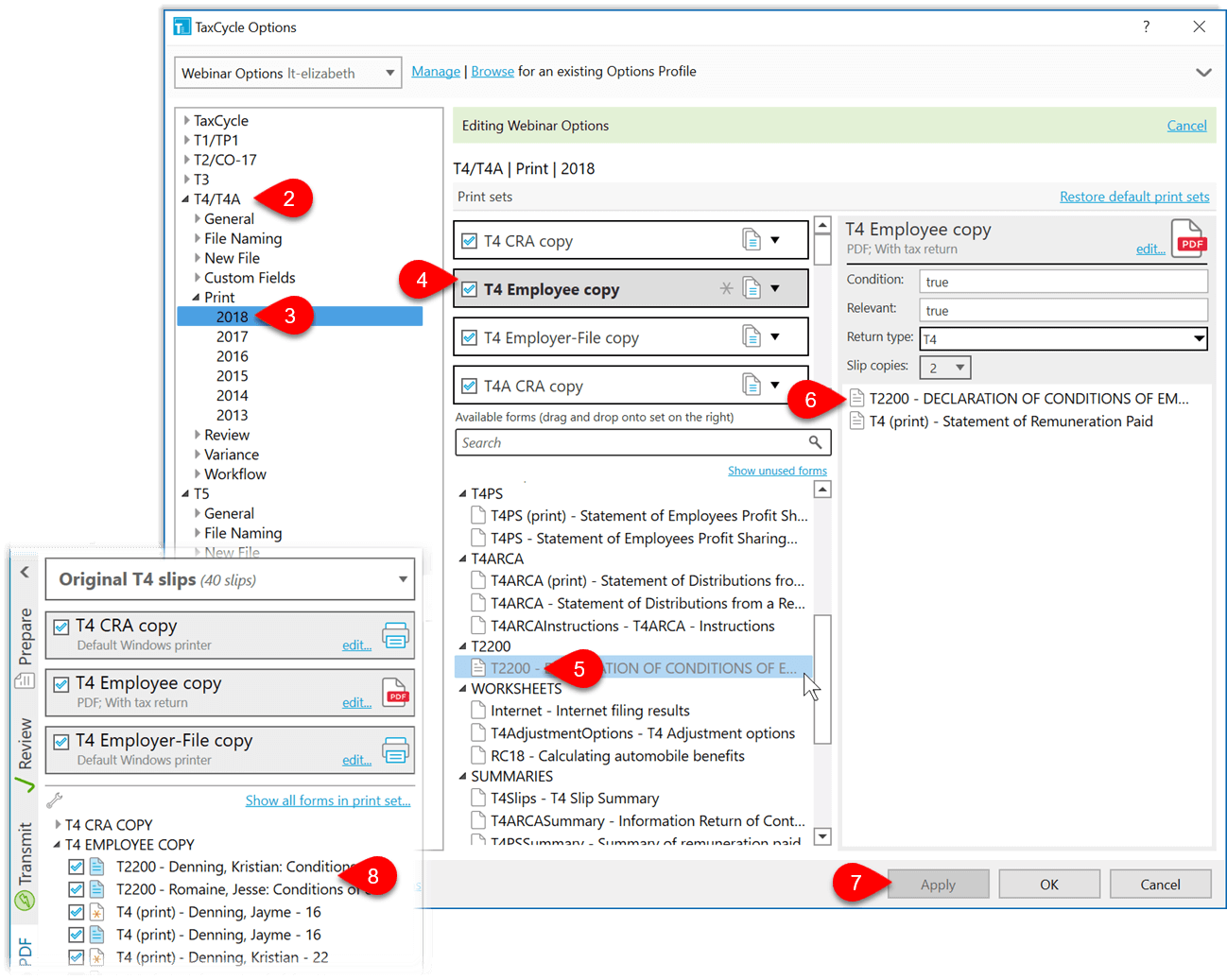

It Is Late March You Have Just Met With Your Chegg Com

T4 Slip Form Page 1 Line 17qq Com

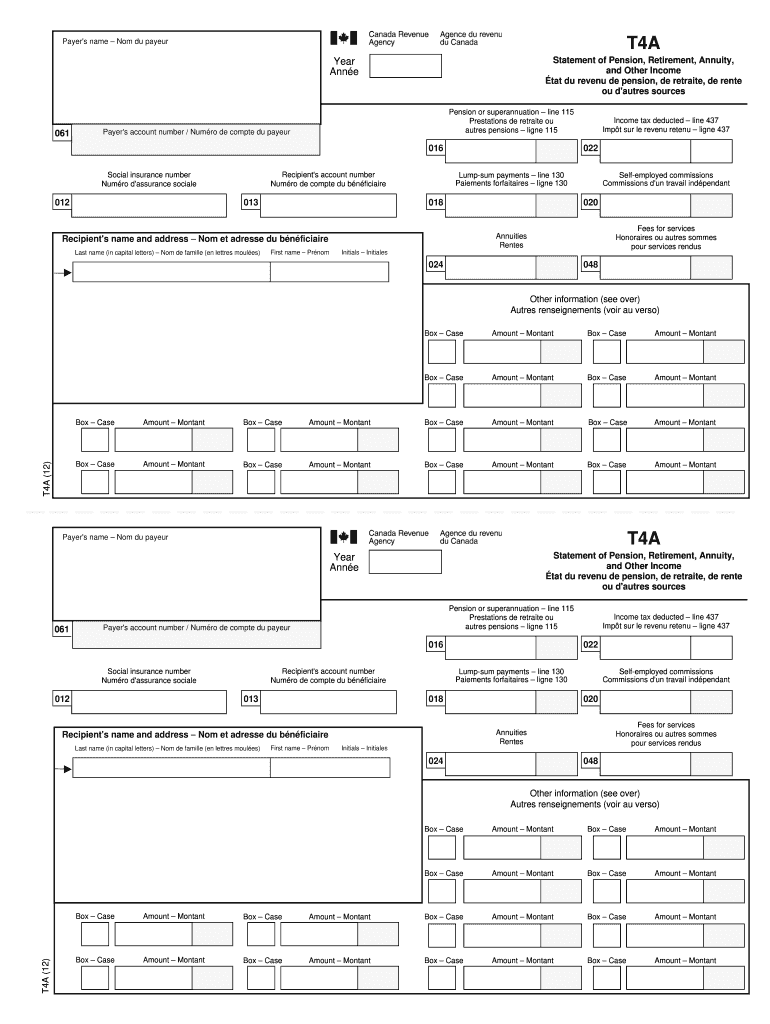

· A T4A slip looks very similar to a T4 slip T4A is generally issued when the payment was made over $500 It applies in case of selfemployed commission income, pensions, annuities, fees for services, scholarships and other income Similar to T4 slip, this has the tax year, Payer's name and Payee's details in the recipient's name and address box Box 0 If the Payee is selfA T4 slip has lots of useful information related to your taxes Hence, you should take good care of it and make sure that you don't lose it Information available in the T4 slip provides clear indication on the total amount that you were paid by the employer before deductions In addition to that, the T4 slip has information related to your Income taxes deducted, Employment Insurance (EI/12/ · What is T4 Box 40?

Cupe4070 Did You Know Union Dues Are Tax Deductible Box 44 On Your T4 Slip From The Employer Will Indicate The 19 Total Union Dues You Contributed T Co Xm5v7xtux0

Creating T4 T4a T5 Tax Slips For Printing And Electronic Filing Youtube

T4a Fillable Fill Online Printable Fillable Blank Pdffiller

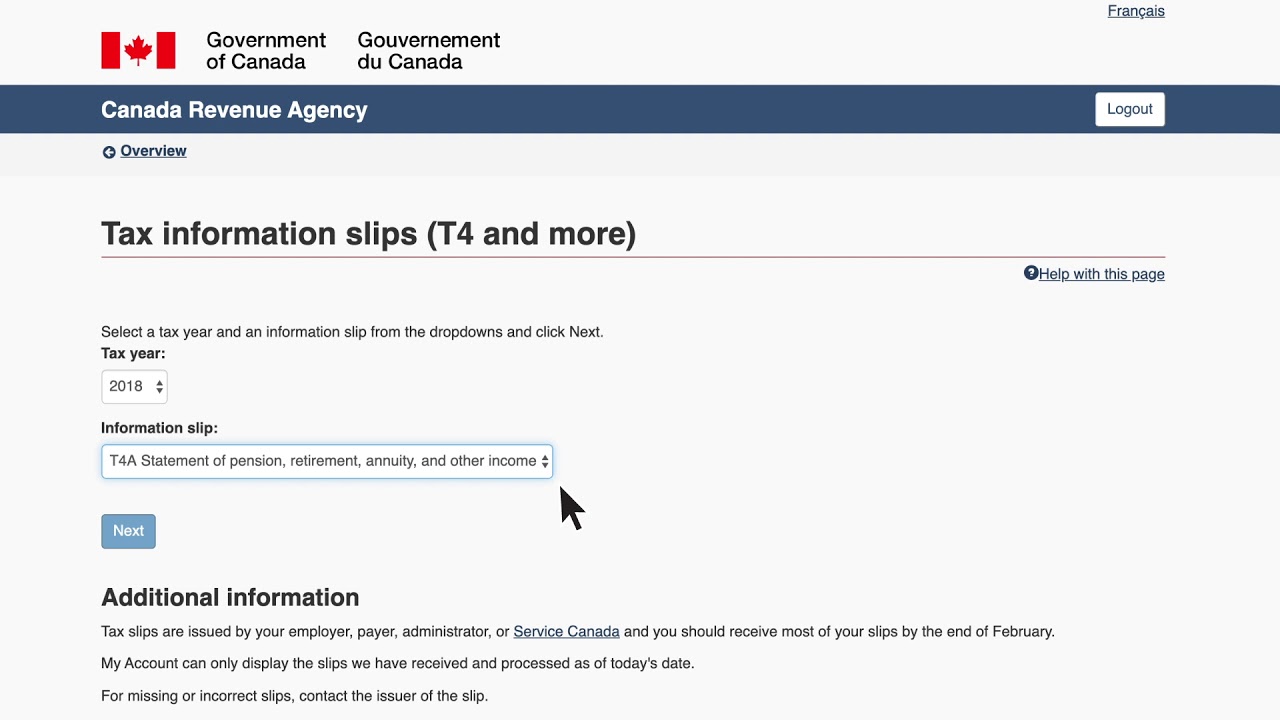

Accessing T Slips On The Canada Revenue Agency Web Site Adjusted Cost Base Ca Blog

T4 Fillable Fill Online Printable Fillable Blank Pdffiller

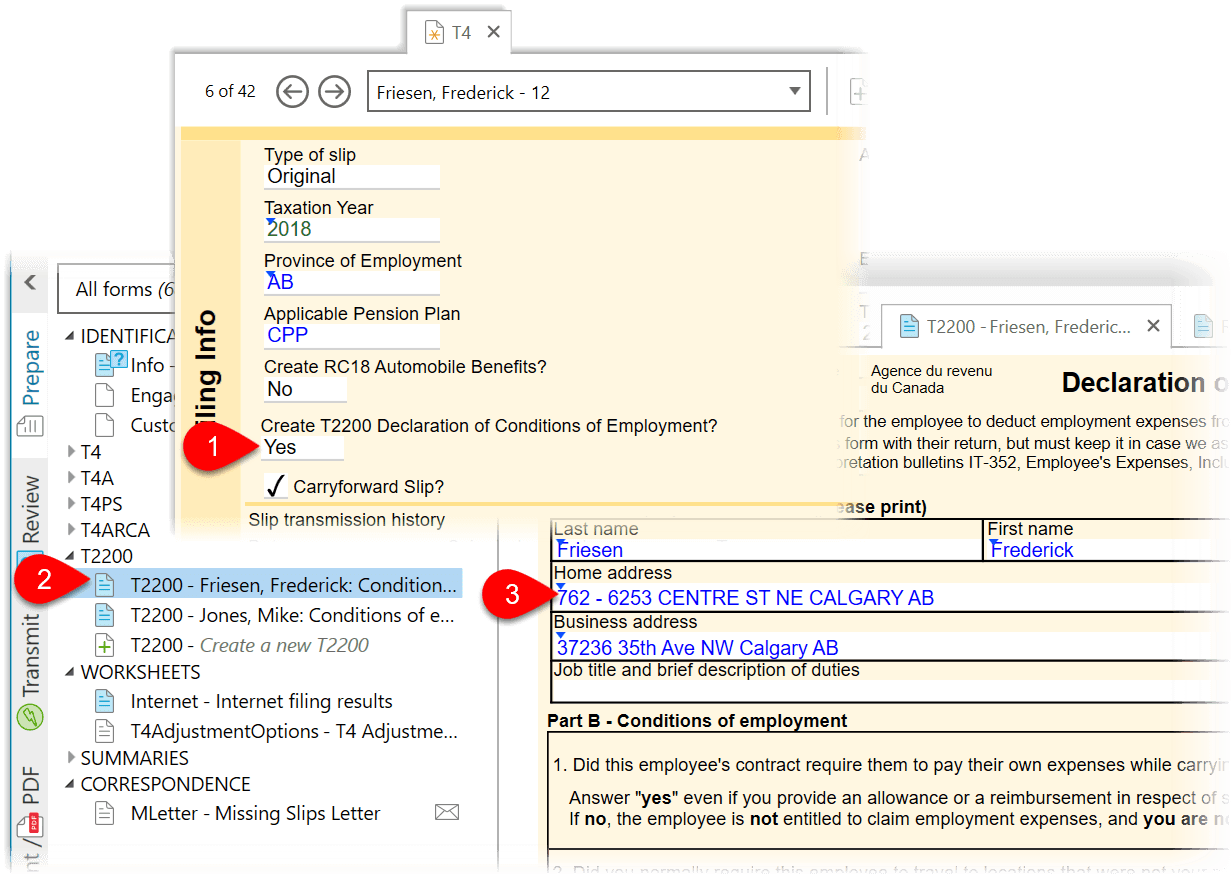

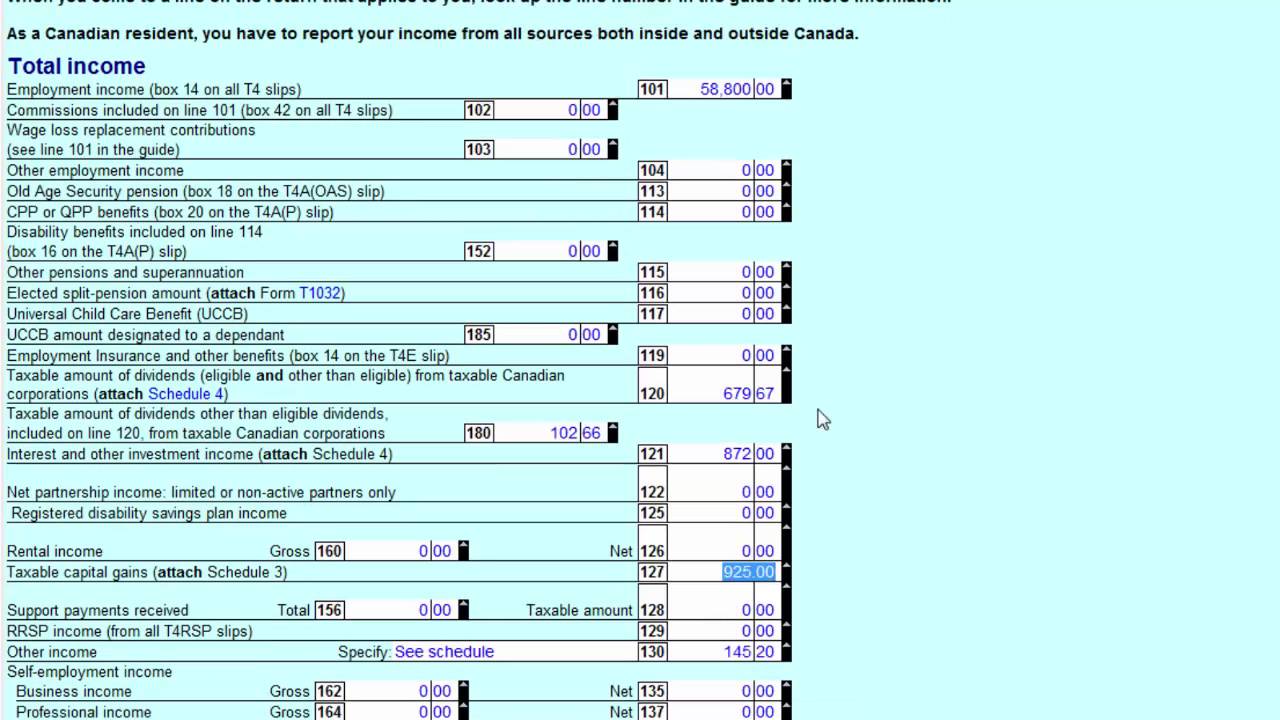

T20 And T20s Conditions Of Employment Taxcycle

Sage 50 Accounting Canadian Edition Preparing T4 Slips And Summary Youtube

/GettyImages-155158109-0035eac2c8b143db917f96755338684a.jpg)

5 Ways To Pay Your Personal Canadian Income Taxes

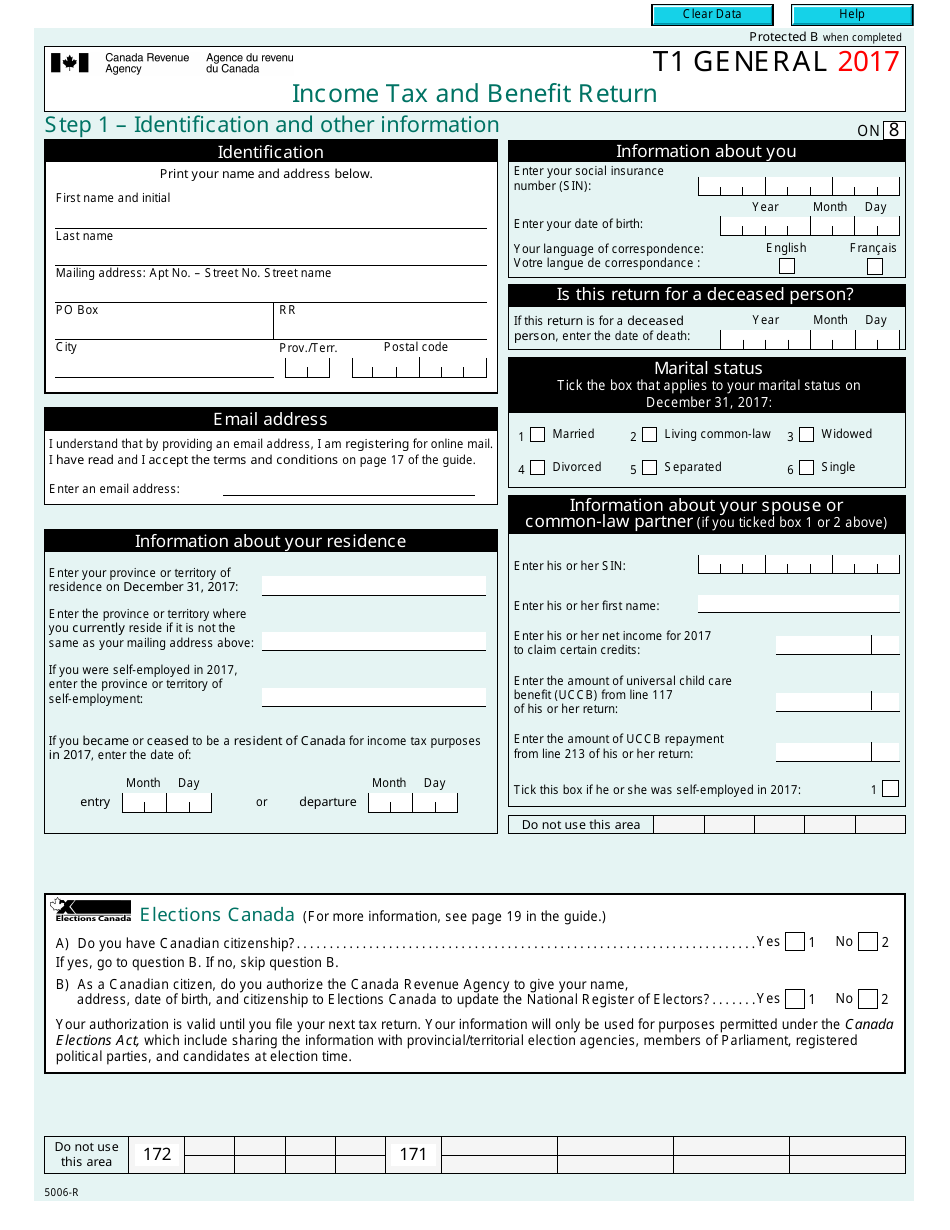

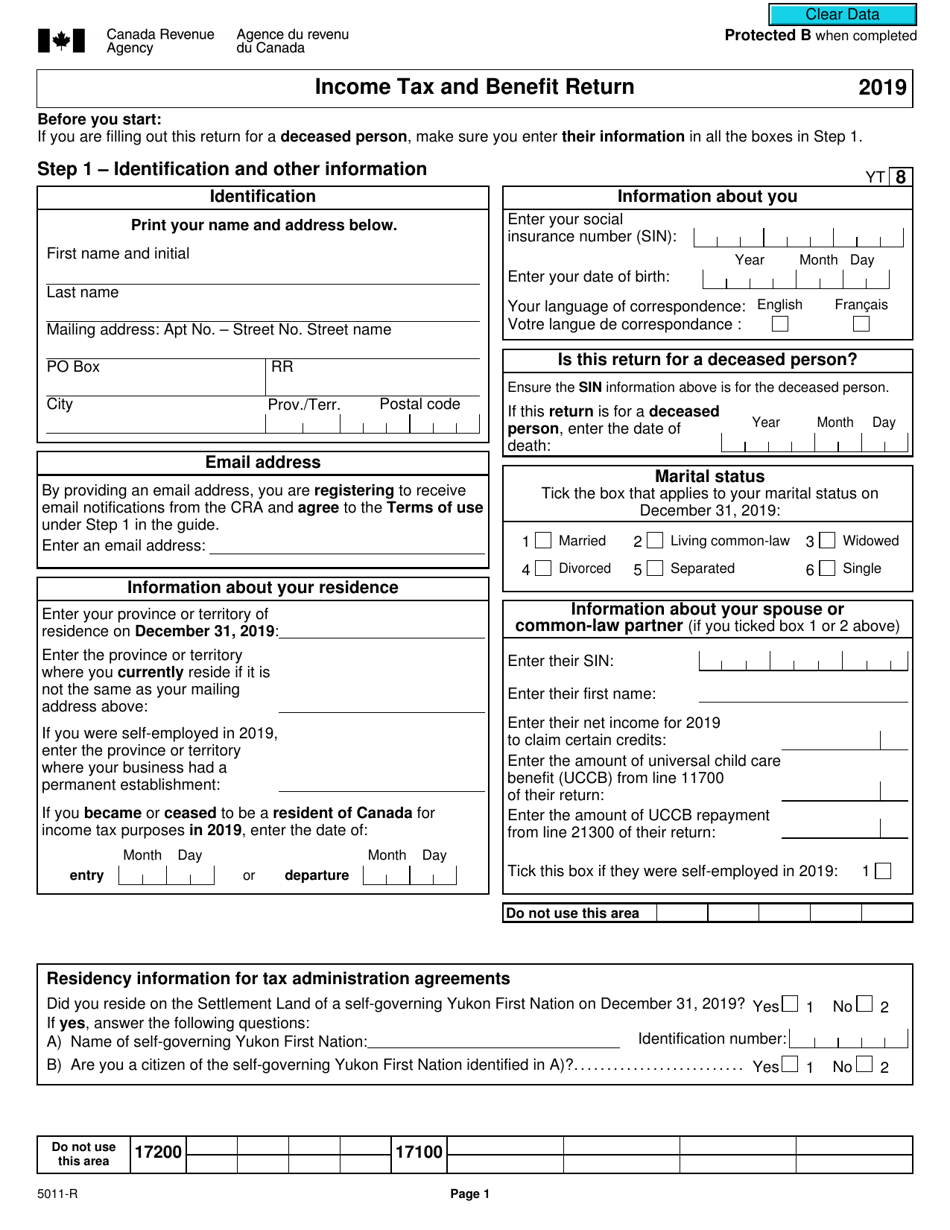

Form T1 General Download Fillable Pdf Or Fill Online Income Tax And Benefit Return 17 Canada Templateroller

Print T4 Slips

T4 Slip Fillable Forms Vincegray14

T4 Vs T4a Differences And When To Issue Which Slip Think Accounting

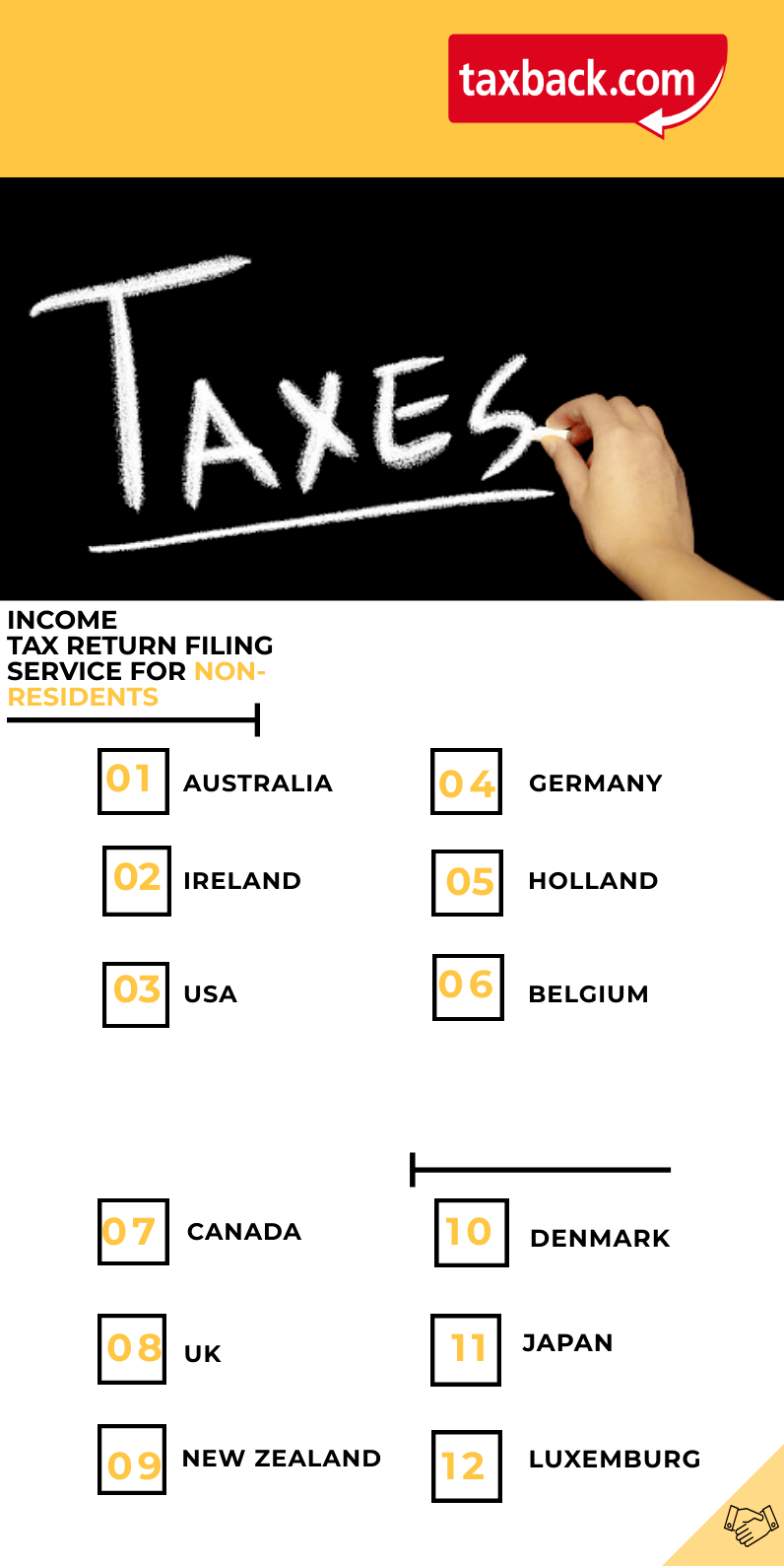

Declaring Foreign Income In Canada

Year End Reporting

T4 Slip Fillable Forms Vincegray14

T4 Slip Form Page 1 Line 17qq Com

Sample Forms

Do You Find Taxes Confusing Mac S Money Centre Mcmaster University

T4 Slip Form Page 1 Line 17qq Com

What S The Difference Between An Noa T4 And T1 General

How To Get A Copy Of Your T4 Slip Turbotax Canada Youtube

Understanding Cra Tax Slips Mileiq Canada

How To Prepare A T5 Slip Youtube

19 21 Form Canada T20 Fill Online Printable Fillable Blank Pdffiller

How To File T4s Using Quickbooks Desktop

T4 Statement Of Remuneration Paid Canada Ca

International Student Services University Of Alberta Doing Your Taxes Forms Facebook

View Tax Forms Humi Support Library

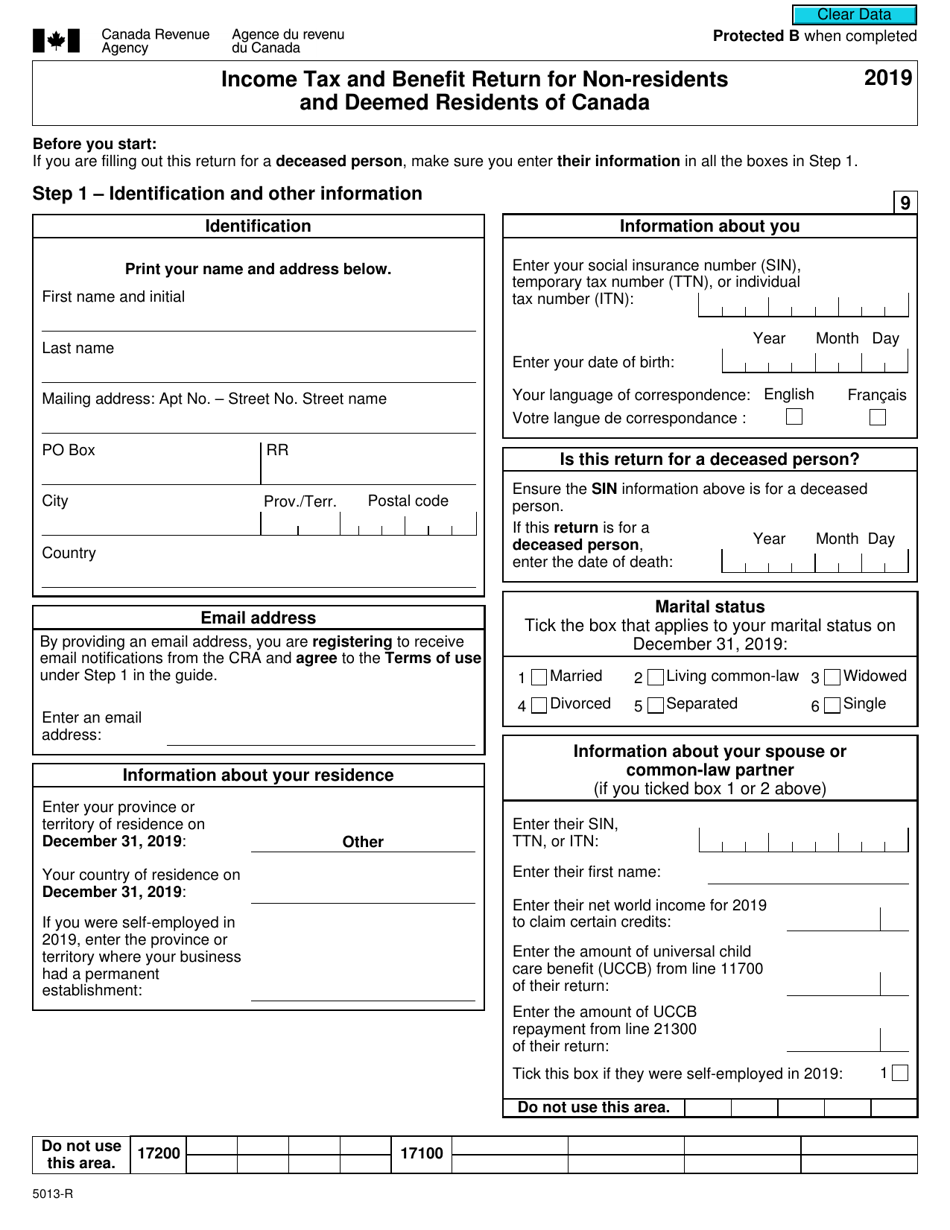

Form 5013 R Download Fillable Pdf Or Fill Online Income Tax And Benefit Return For Non Residents And Deemed Residents Of Canada 19 Canada Templateroller

Creating T4 T4a And Rl 1 Tax Slips Paymentevolution Support

Box 22 6 3 Ab 7 515 Sk 8 041 Mb 9 056 On 7 335 Nb 8 623 Ns 9 211 Pe 9 122 Nl 8 707 Yt 7 003 Nt 6 118 Nu Course Hero

Form Canada T4 Summary Fill Online Printable Fillable Blank Pdffiller

It Is Late March You Have Just Met With Your Chegg Com

/161542227-56a0e4ef5f9b58eba4b4ebee.jpg)

What Is A T4a Canadian Income Tax Slip

T20 And T20s Conditions Of Employment Taxcycle

Information On Filing T4s Rl 1s And T4as For Small Business Owners

Difference Between T1 And T4 Income Tax Tax Walls

Difference Between T1 And T4 Income Tax Tax Walls

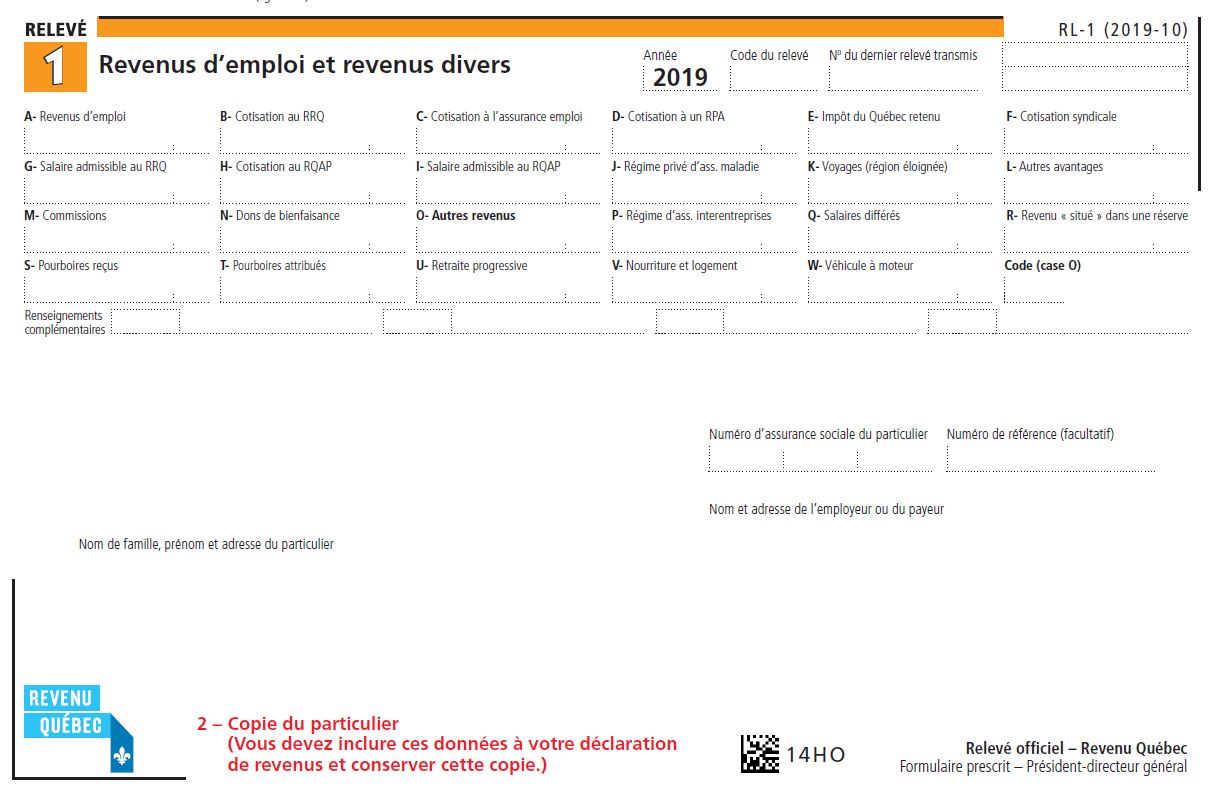

Solved How Can I Enter My Releve 1 While I Have Income Fr

Canada T4 Tax Form Page 1 Line 17qq Com

Form 5011 R Download Fillable Pdf Or Fill Online Income Tax And Benefit Return 19 Canada Templateroller

T4 Slips And Tax Tips Taking The Stress Out Of Filing Ama

Individual Income Tax Return Checklist Maroof Hs Cpa Professional Corporation Toronto

Form T4 Download Fillable Pdf Or Fill Online Statement Of Remuneration Paid Canada English French Templateroller

Form W 2 Wikipedia

/calculating-employment-income-lge-56a0e4ee3df78cafdaa62277.jpg)

How To Use T4 Slips To File Income Taxes

Ensure T4 Slips Comply With The Reporting Requirements Mccay Duff Llp Chartered Professional Ottawa Accountants

Income Tax Common Mistakes Made On Tax Returns Ctv News

Print Pdf Slips Taxcycle

Received A T4a Slip You Must File A Tax Return In Canada

Error In 17 Version Of Turbotax Online The Rl1

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 17 As An Example Youtube

How To Download Print Quickbooks Online Qbo Canadian T4s For Employees Youtube

Employer S Name Nom De L Employeu Canada Revenue Agonce Ou Revenu T4 Neat As A Pin Year 19 Statement Of Remuneration Paid Etat De La Remuneration Course Hero

The Canadian Employer S Guide To The T4 Bench Accounting

T4 Slip Form Page 1 Line 17qq Com

Anti Slip Rubber Gate Slot Cup Mat For Volvo Xc60 18 19 2nd Gen R Design R Design Accessories Stickers T4 T5 T6 D4 D5 Floor Mats Aliexpress

T4 Slip Fillable Forms Vincegray14

Employer S Name Nom De L Employeu Canada Revenue Agonce Ou Revenu T4 Neat As A Pin Year 19 Statement Of Remuneration Paid Etat De La Remuneration Course Hero

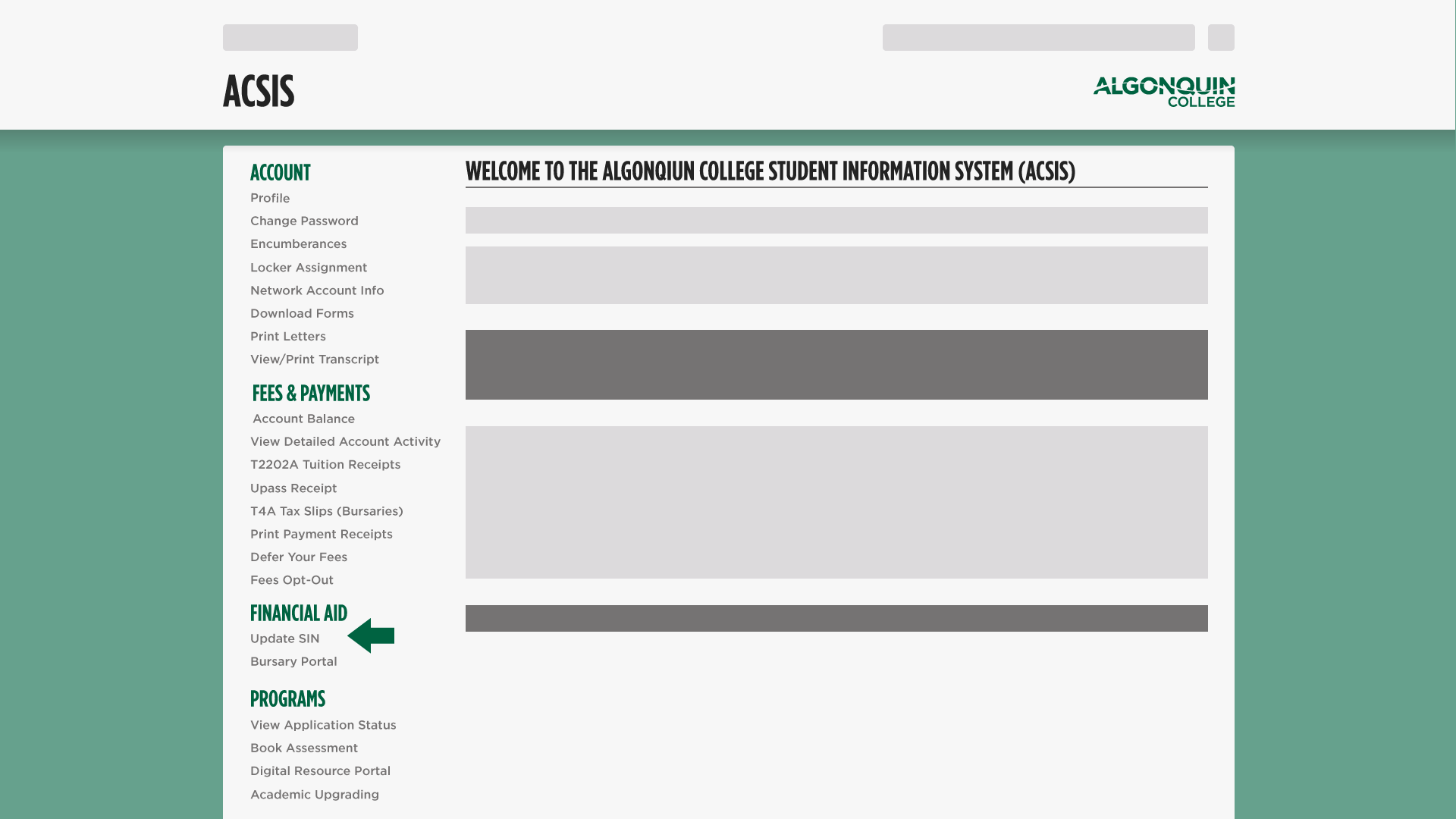

Tax Receipts Registrar S Office Financial Aid

For Volvo S90 Anti Slip Rubber Cup Cushion Door Groove Mat S90 T4 T5 T6 T8 D3 D4 D5 Awd 17 18 19 Accessories Car Stickers Floor Mats Aliexpress

Employer S Name Nom De L Employeur Canada Revenue Agency Agence Du Revenu Du Canada T4 Neat As A Pin Year Statement Of Remuneration Paid Annee 19 Course Hero

T4 Slip Form Page 1 Line 17qq Com

Find And Navigate Slips Taxcycle

T4 Slip Form Line 150 Page 1 Line 17qq Com

Information Returns By Employers In Canada Maroof Hs Cpa Professional Corporation Toronto

Box 32 On The T4a Is The Sum Of Lines 126 And 162

Canada Revenue Agency Heads Up Employers To Help Validate Payments Made Under The Cerb Cews And Cesb We Will Be Introducing Additional Reporting For The T4 Slip For All Employers Learn

T4 Slip Fillable And Printable Fill Online Printable Fillable Blank Pdffiller

How To Do Taxes A Student S Guide Imprint

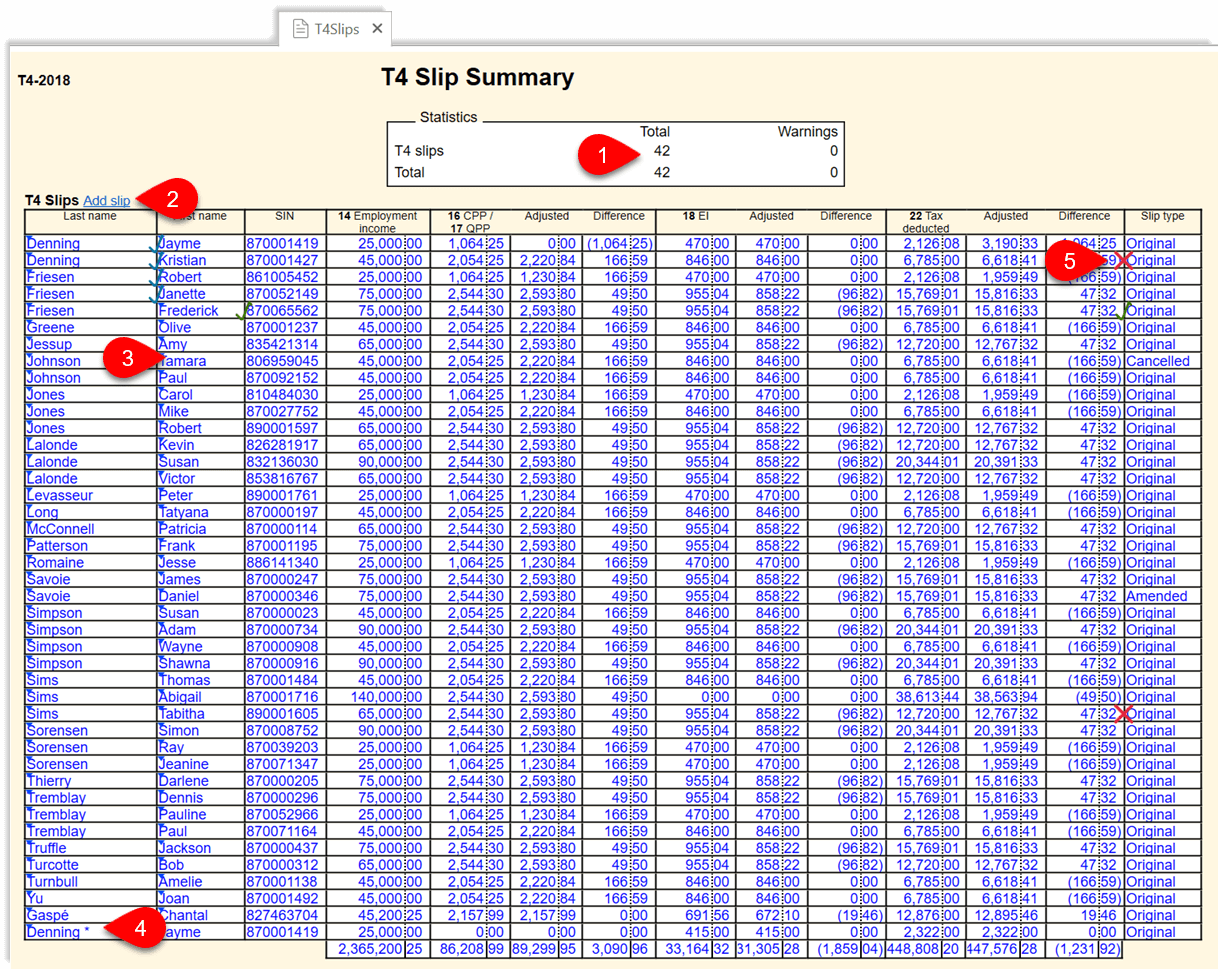

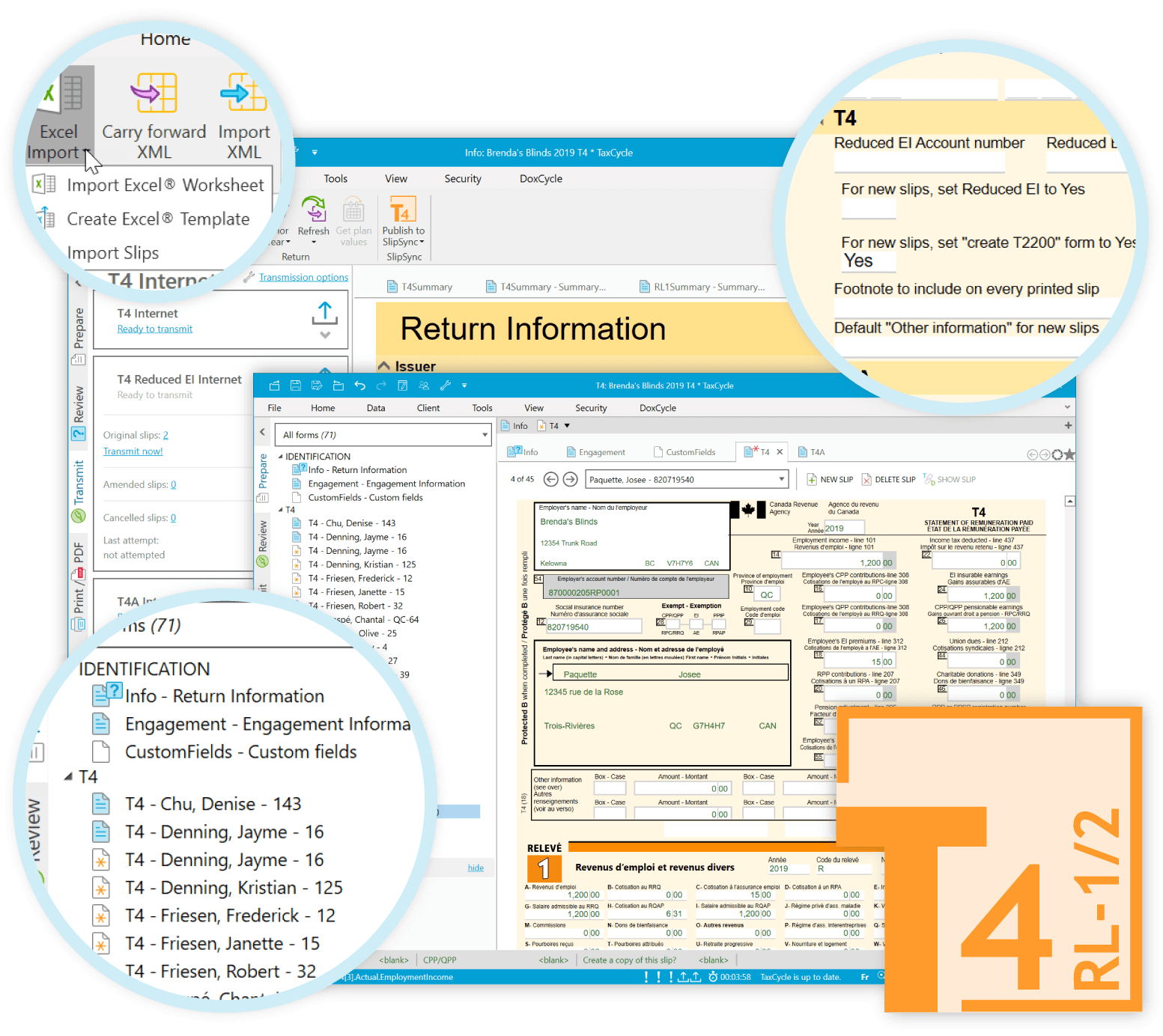

Taxcycle T4 T4a Taxcycle

0 件のコメント:

コメントを投稿